A Home Equity Line of Credit, or HELOC, allows you to access the equity in your home with a revolving line of credit, secured by your home. The funds can be used for any financial need, such as making home improvements, consolidating of high-interest credit cards, paying for college expenses, or if you’d simply like to have quick access to to emergency funds.

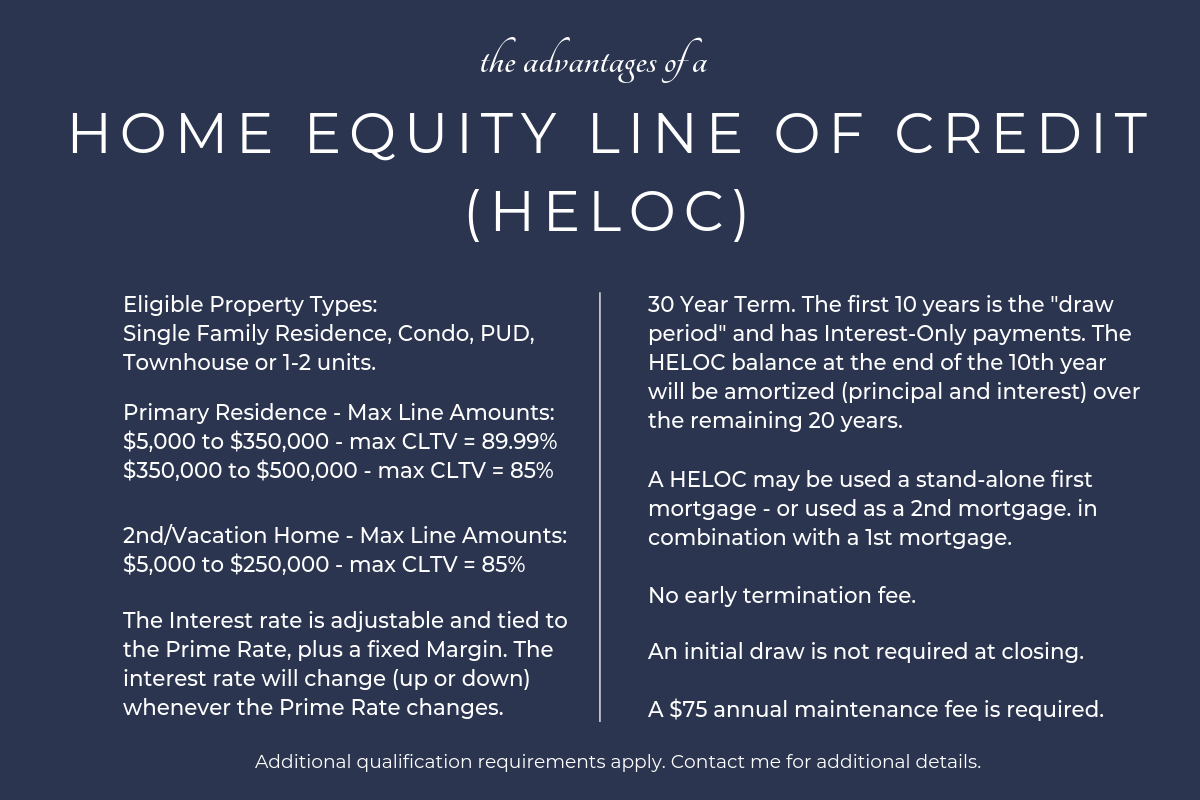

With property values at all time highs, now may be the perfect time tap into your home’s equity, with a Home Equity Line of Credit, even if you don’t need the funds right away. A Home Equity Line of Credit has a 10 year “draw period” where, during this time, you can borrower and repay the funds, as often as you wish, up to the available credit line. A Home Equity Line of Credit has “interest-only” payments, for the first 10 years and you’ll only pay interest on the amount you’ve used. At the end of the draw period, the ability to draw funds will stop and the outstanding balance, at that time, will be amortized over the remaining 20 years.

Planning for your financial security is essential. A Home Equity Line of Credit can give you peace of mind knowing you’ll have funds available, for all of life’s big moments.