A conventional loan is any type of loan that is not guaranteed or insured by a government entity, such as FHA, VA or USDA. Conforming and high-balance conforming loans meet the guidelines established by Fannie Mae (FNMA) and Freddie Mac (FHLMC). While Fannie Mae and Freddie Mac do not issue loans directly, they buy loans and sell them in the secondary market, to provide stability, liquidity and affordability to the mortgage market.

Conventional loans are, by far, the most popular type of mortgage for homebuyers and homeowners who refinance. In fact, conventional loans have accounted for more than 70% all new home sales in the U.S. for the past two years.

Conventional loans include conforming loans, which go up to loan amounts of $766,550.00 and “high-balance” conforming loans, which go up to $1,149,825.00, in certain high-cost areas across the country.

Jumbo loans are also considered conventional loans, but since they do not conform to Fannie Mae or Freddie Mac guidelines, they’re referred to an “non-conforming” loans. For more information about non-conforming loans, refer to Jumbo Loans (under the Loan Product menu).

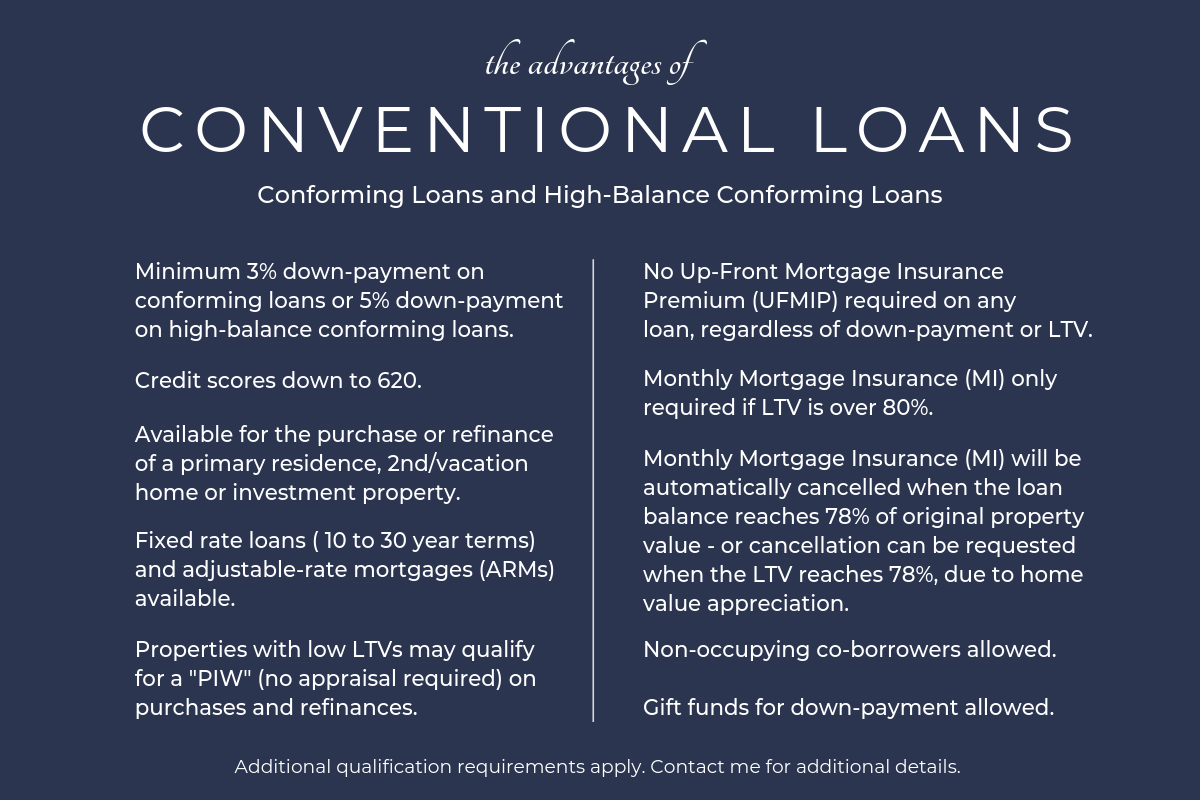

Following are some of the reasons why conventional loans (both conforming and high-balance conforming) are so popular: